避免開設過多新帳戶。

Opening multiple new credit accounts within a short period may raise concerns for lenders, affecting your credit score. Only apply for credit when necessary and be mindful of the potential impact.

短時間內開設多個新的信用卡帳戶會對您的信用評分產生負面影響。貸款機構可能會將此視為危險信號,並對您的財務穩定性和償債能力產生擔憂。

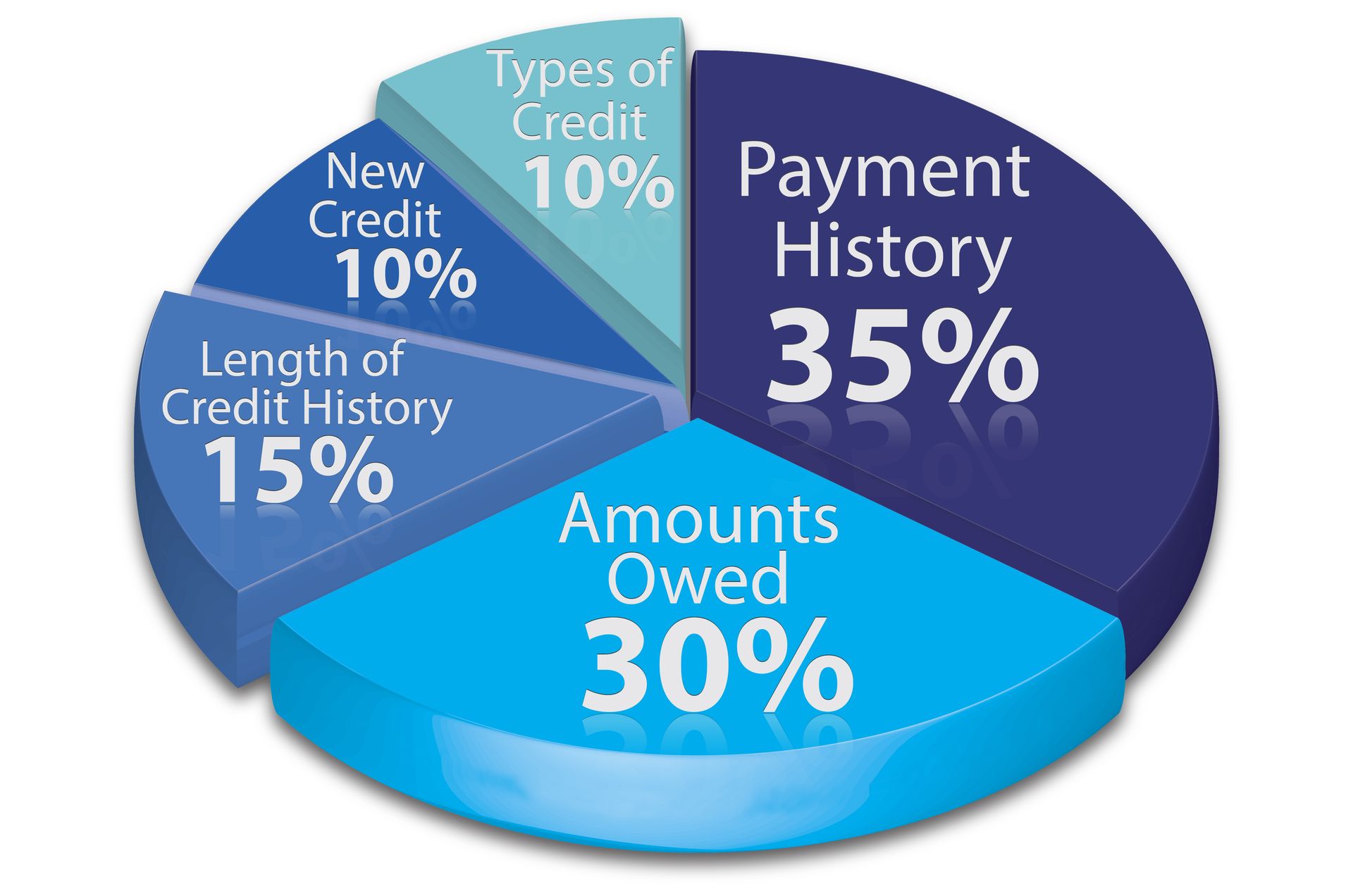

開設多個新帳戶會影響信用評分的主要原因之一是,這會降低您的平均信用歷史長度。貸款機構更傾向於查看較長的信用歷史,因為這能讓他們更全面地了解您的財務習慣和負責任的借貸行為。如果您在短時間內開設多個新帳戶,會顯著降低您的平均信用歷史時長,這可能導致信用評分下降。

Additionally, each time you apply for credit, a hard inquiry is made on your credit report. These inquiries remain on your credit report for two years and too many inquiries within a short time frame can signal to lenders that you are seeking credit for desperate reasons. This could raise concerns about your financial stability and may result in a lower credit score.

為了避免這種潛在的負面影響,請務必僅在必要時申請信貸。在申請新的信貸帳戶之前,請考慮您是否真的需要它,以及它是否符合您的整體財務目標。衝動或出於不必要的原因申請信貸可能會影響您的信用評分。

If you do need to open a new credit account, try spacing out your applications over a longer period of time. This allows your credit history to remain stable and minimizes the negative impact on your credit score. It is also advisable to monitor your credit report regularly to ensure that all the information is accurate and up to date.

In conclusion, opening multiple new credit accounts within a short period can raise concerns for lenders and affect your credit score. It is important to apply for credit only when necessary and be mindful of the potential impact on your credit history. By practicing responsible credit management and avoiding unnecessary new accounts, you can maintain a healthy credit score and financial stability.