Evite abrir demasiadas cuentas nuevas.

Opening multiple new credit accounts within a short period may raise concerns for lenders, affecting your credit score. Only apply for credit when necessary and be mindful of the potential impact.

Abrir varias cuentas de crédito nuevas en un corto período de tiempo puede tener un impacto negativo en su puntaje crediticio. Los prestamistas pueden considerar esto una señal de alerta y generar inquietudes sobre su estabilidad financiera y su capacidad para pagar sus deudas.

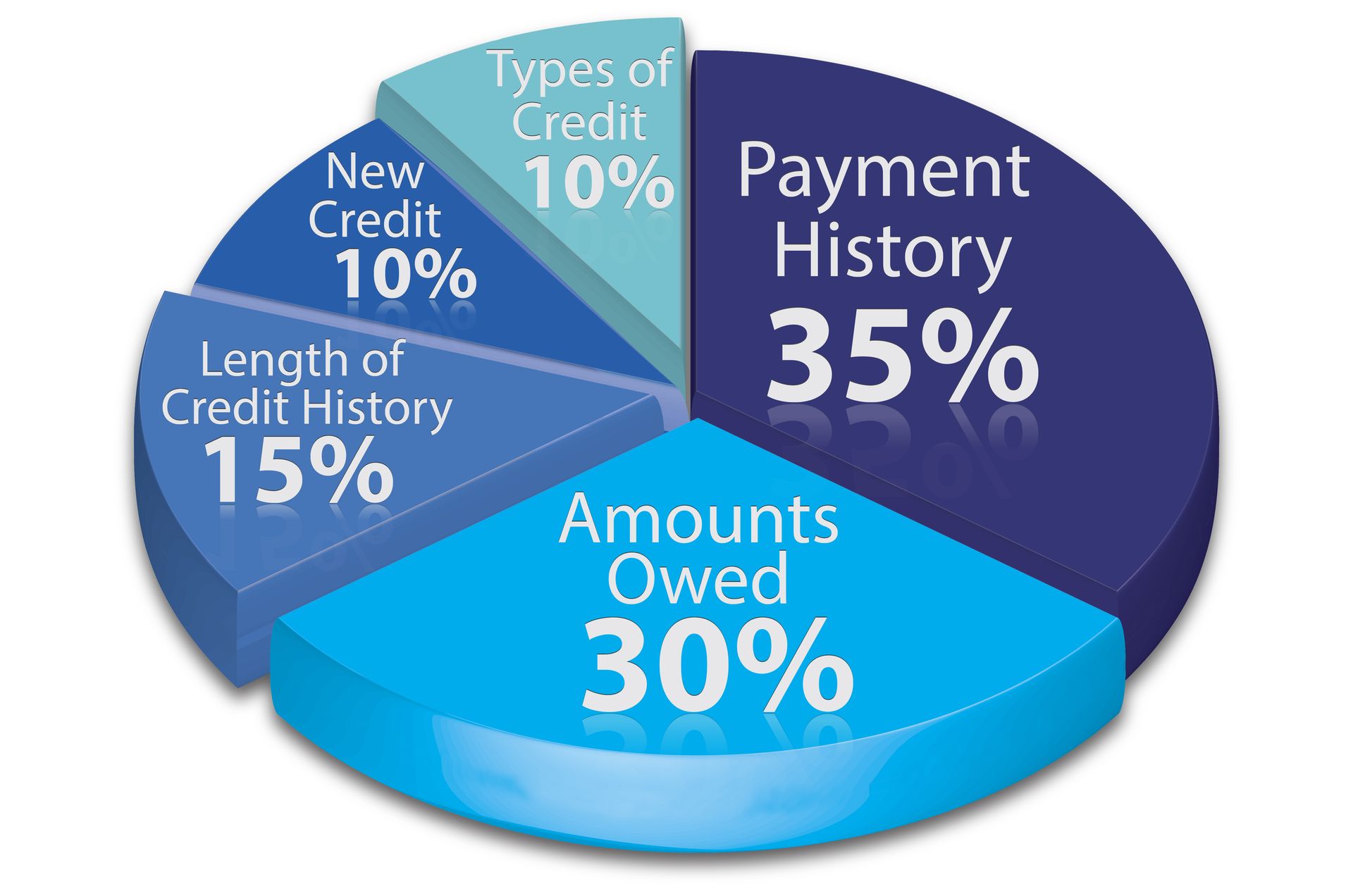

Una de las principales razones por las que abrir varias cuentas nuevas puede afectar su puntaje crediticio es que puede reducir la antigüedad promedio de su historial crediticio. Los prestamistas prefieren ver un historial crediticio más extenso, ya que les proporciona más información sobre sus hábitos financieros y su comportamiento crediticio responsable. Abrir varias cuentas nuevas en un corto período puede reducir significativamente la antigüedad promedio de su historial crediticio, lo que podría resultar en un puntaje crediticio más bajo.

Additionally, each time you apply for credit, a hard inquiry is made on your credit report. These inquiries remain on your credit report for two years and too many inquiries within a short time frame can signal to lenders that you are seeking credit for desperate reasons. This could raise concerns about your financial stability and may result in a lower credit score.

To avoid this potential negative impact, it is important to only apply for credit when necessary. Before applying for a new credit account, consider whether you genuinely need it and if it aligns with your overall financial goals. Applying for credit impulsively or for unnecessary reasons can have consequences on your credit score.

If you do need to open a new credit account, try spacing out your applications over a longer period of time. This allows your credit history to remain stable and minimizes the negative impact on your credit score. It is also advisable to monitor your credit report regularly to ensure that all the information is accurate and up to date.

In conclusion, opening multiple new credit accounts within a short period can raise concerns for lenders and affect your credit score. It is important to apply for credit only when necessary and be mindful of the potential impact on your credit history. By practicing responsible credit management and avoiding unnecessary new accounts, you can maintain a healthy credit score and financial stability.